carried interest tax reform

Carried interest should receive capital gains tax treatment because it represents a return on an underlying long-term capital asset as well as risk and entrepreneurial activity. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains.

The Realty Developers In Yamuna Expressway Have Been Warned By Authorities That No Flats Could Be Booked Or Construction Activities Carried Ou World Agra India

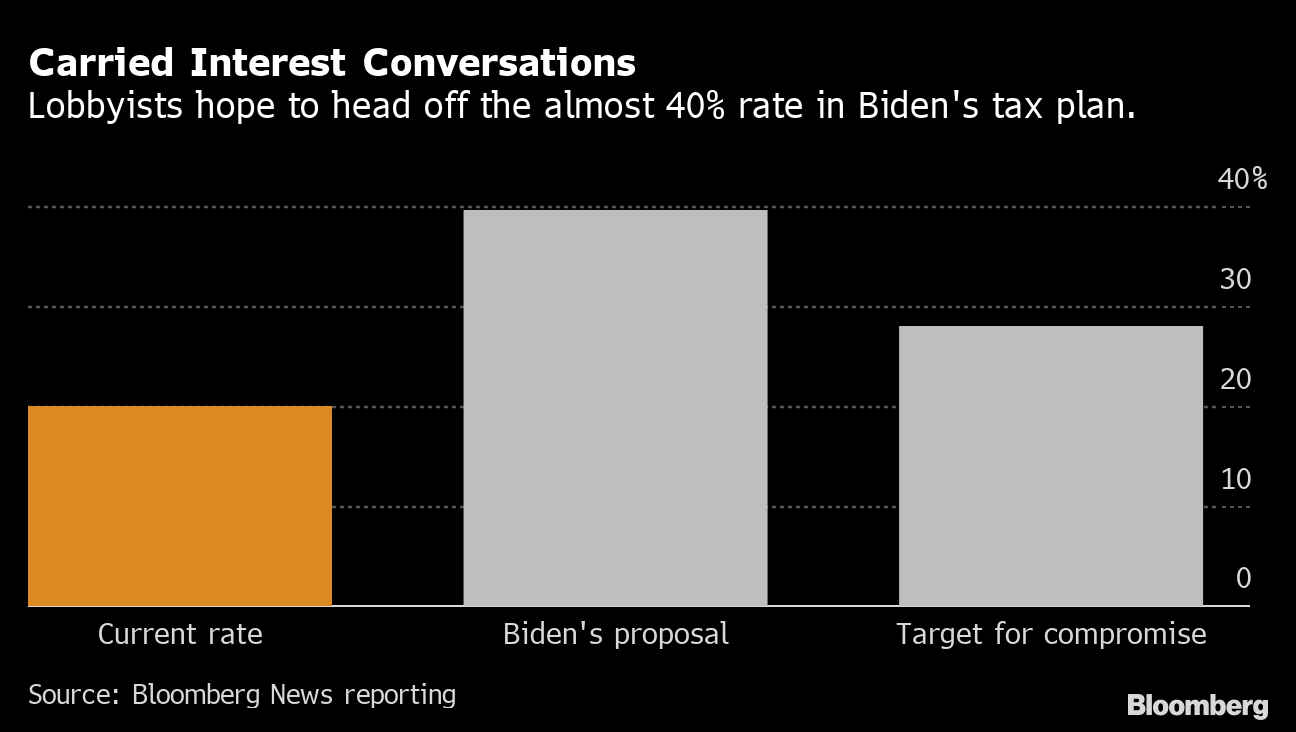

But closing the so-called carried interest loophole by taxing private equity profits at personal income rates instead of at lower capital gains rates is.

. Carried interest is taxed2 The most recent effort to address the tax treatment of carried interest was in the federal Tax Cuts and Jobs Act PL. This is in contrast to any fees that managing partners receive in payment for operations and management activities which are taxed as ordinary income. This new code section is targeted toward managers in the private equity and hedge fund industry who in exchange for services often receive a percentage of a funds future profits the so-called carried interest or profits interest.

By Keefe Borden. A proposed change to tax laws for partnerships has drawn stiff opposition from two advocacy organizations for builders. Carried interest is the tax paid by members of partnerships when profits are distributed.

New York Governor Andrew Cuomo announced in January that he is seeking to change the treatment of carried interest for state tax purposes and impose additional tax on hedge fund managers working in New York. Tax reform is still making an impact on the way you do business. The carried-interest loophole is a misunderstood and often misrepresented feature of US.

To begin with it isnt a loophole at all. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. By Keefe Borden.

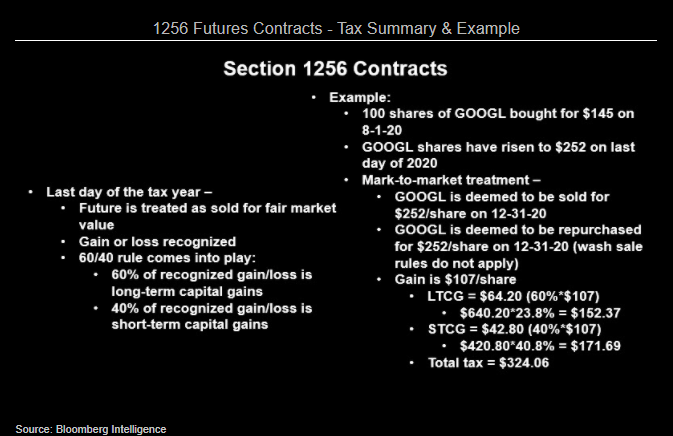

It qualifies as capital gains and it is taxed at the 238 perfect rate rather than the nearly 40 income tax rate. A report by the accounting firm KPMG on the American Jobs and Closing Tax Loopholes Act which passed the Democratic-controlled House in 2010 and applied tax treatment to carried interest similar to the Biden plan found that the bill could apply to partnerships in virtually any kind of business and could fundamentally change how partnerships are taxed. Carried interest is the portion of an investment funds returns eligible for a capital gains tax rate of 238 instead of the ordinary income tax rate up.

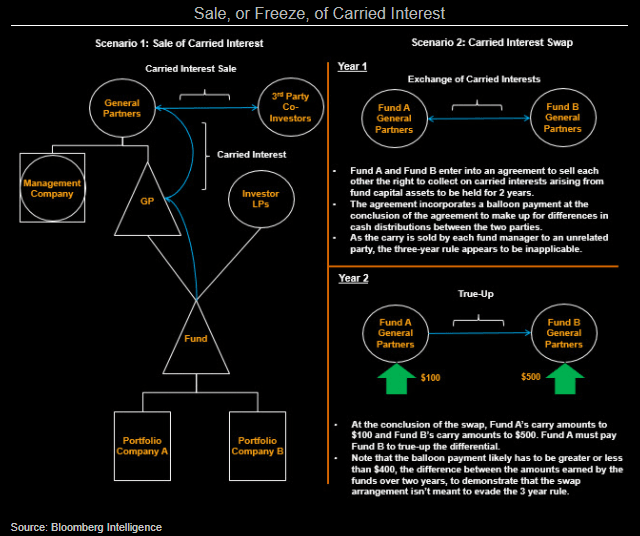

Sander Levin today reintroduced legislation to tax carried interest compensation at the same ordinary income tax rates paid by other Americans. A proposed change to tax laws for partnerships has drawn stiff opposition from two advocacy organizations for builders. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free loan from the.

1068 otherwise known as the Carried Interest Fairness Act of 2021 would boost taxes on real estate by requiring carried interest to be classified and taxed as ordinary income rather than as a capital gain. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers. Carried interest allows hedge funds to evade their tax obligations.

Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities. Review new regulations before assessing your tax situation. Though there is a lot of inflammatory political rhetoric directed at the tax treatment of carried interest theres a limited.

Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Some view this tax preference as an unfair market-distorting loophole. This new section extends the holding period for long-term capital gain or loss treatment as it relates to carried interest.

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Key insights The IRS issued final regulations under Section 1061 that provide much-needed clarity on carried interests. Carried interest reform is a sham - The Washington Post Republican lawmakers carried interest reform doesnt require proceeds from profits interests to be treated as ordinary income which.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. Levin Reintroduces Carried Interest Tax Reform Legislation Apr 3 2009 Press Release Washington DC Rep. 1068 otherwise known as the Carried Interest Fairness Act of 2021 would boost taxes on real estate by requiring carried interest to be classified and taxed as ordinary income rather than as a capital gain.

Having escaped federal tax reform largely unscathed fund managers and other holders of carried interests now need to look to the states. Tax Reform 322021 While the future of carried interest and long-term capital gain tax rates may remain in flux we do have clarity on required holding periods. If Congress ultimately sends a tax reform bill to President Trump including provisions like those contained in the House legislation it.

Hiking taxes on carried interest capital gains is one such proposal. Among many other changes the TCJA added new IRC section 1061.

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

Moving Toward More Equitable State Tax Systems Itep

Goods And Services Tax Gst Is A Huge Reform For Indirect Taxation In India The Likes Of Which T Goods And Service Tax Accounting Services Goods And Services

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Lobbying Kept Carried Interest Out Of Biden S Tax Plan Bernstein Says

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

What Is E Way Bill Under Gst Goods And Services Internet Usage Goods And Service Tax

Carried Interest Deductibility What Is The Best Option For Your Family Office Structure Goulston Storrs Pc Jdsupra

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Gst Transitional Provisions Https Taxguru In Goods And Service Tax Gst Transitional Provisions Html Corporate Law Goods And Services Goods And Service Tax

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Duties And Taxes Not Subsumed Into Gst Accounting Taxation Tax Goods And Service Tax State Tax

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)